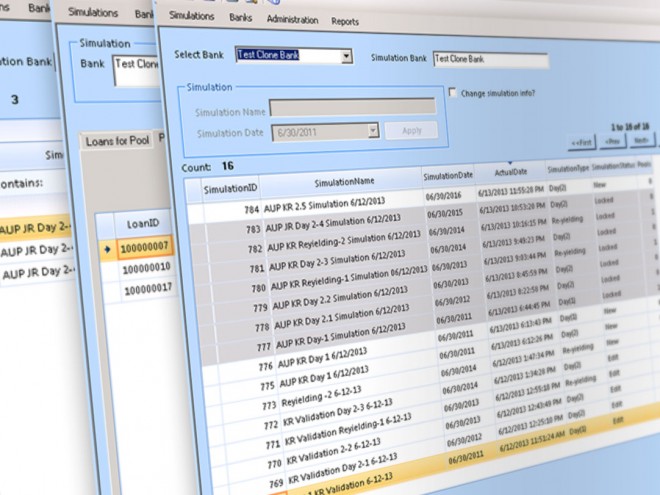

LAWEI: Loans Acquired With Evidence of Impairment

LAWEI, our expected cash flow model solution, guides your Bank step by step in the correct implementation and automated accounting for loans that have been designated as ASC 310-30 loans. It is our recommendation that Banks use the approved methodology of applying ASC 310-30 treatment to as many of your acquired loans by analogy and implement LAWEI Solution in order to obtain the earnings protection afforded by the pronouncement.

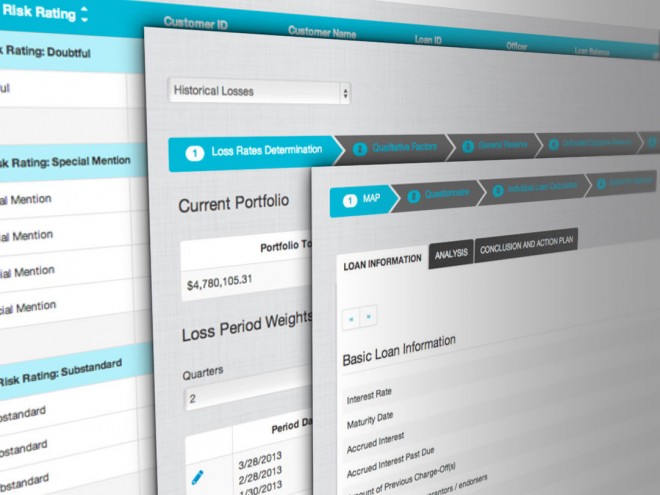

ATLAS: Allowance for Loan and Lease Losses (ALLL) Solution

ATLAS is the first true troubled and classified loan smart assistant. ATLAS is an automated solution designed by former bankers and bank auditors. Thus, our application development and consulting efforts are focused on allowing bankers to execute on what they do best and achieve the accounting as a by-product of the process. By using ATLAS, complying with the finance and regulatory requirements is naturally integrated into your regular troubled and classified loan management process.

Asset Liability Management Review

LogiqTree will assist your Asset Liability Management committee in evaluating the completeness and strength of your ALCO package as well as the quality of information provided to senior management and the board.

Our review will assist management in identifying independently potentially unforeseen scenarios that could significantly enhance or impact earnings, while ensuring that the focus of ALCO is directed towards strategy within the compliance framework.

Our South Florida based team has over forty five years of collective banking, accounting and software development experience so we understand our client's goals and challenges. Our focus is to assist you in developing and successfully implementing strategies that will allow you to dedicate your valuable time and resources to revenue producing activities.